Initial Coin Offerings (ICOs) have been a popular way for blockchain projects to raise funds. However, scammers have exploited the ICO model to deceive investors and steal millions of dollars. Fake ICO scams promise high returns, innovative technology, and exclusive opportunities, but in reality, they are designed to siphon funds from unsuspecting investors.

Fake ICOs often feature fabricated whitepapers, misleading partnerships, and aggressive marketing tactics. In this guide, you will learn how fake ICO scams operate, real-world examples, warning signs to watch for, and how to protect yourself from investing in fraudulent projects.

1. What Is a Fake ICO Scam?

A fake ICO scam is a fraudulent fundraising campaign where scammers create a bogus cryptocurrency project, convince investors to buy tokens, and then disappear with the funds.

How Fake ICO Scams Work

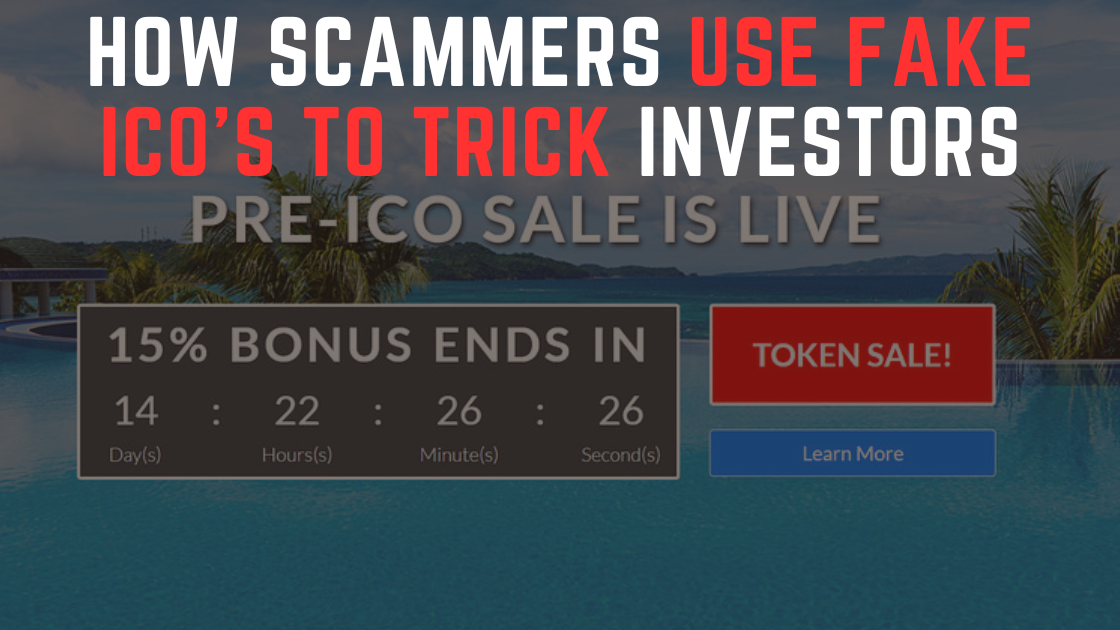

- Creation of a Fake Project – Scammers develop a fake website and whitepaper to mimic a real ICO.

- Hyped Marketing Campaign – They use social media, influencers, and fake news articles to build credibility.

- Limited-Time Offer & FOMO – The ICO is presented as an exclusive opportunity with a limited supply.

- Collection of Investor Funds – Investors send cryptocurrency to a wallet controlled by scammers.

- Exit Scam – Once enough funds are collected, the team disappears, and the project ceases all communication.

Common Methods Used in Fake ICO Scams

- Fake Whitepapers – Plagiarized or AI-generated documents.

- Forged Team Members – Stock photos or impersonated LinkedIn profiles.

- Unrealistic Promises – Claims of guaranteed high returns.

- Paid Influencer Promotions – Fake endorsements from YouTube and Twitter/X personalities.

- Telegram & WhatsApp Hype Groups – Coordinated campaigns to lure investors.

2. Real-Life Fake ICO Scam Examples

Example 1: PlexCoin Scam (2017)

PlexCoin promised massive returns and raised over $15 million before being shut down by the SEC. The founder was arrested for fraud.

More details: SEC Charges PlexCoin

Example 2: Bitcoiin2Gen and Steven Seagal Endorsement

This fraudulent ICO used celebrity endorsement from actor Steven Seagal to mislead investors. It was later revealed as a scam, and Seagal was fined by the SEC.

More details: SEC Fines Steven Seagal

Example 3: Prodeum Scam (2018)

Prodeum claimed to be a blockchain project for agricultural tracking. After raising funds, the website disappeared, leaving behind only the word “penis” on the homepage as a final insult to victims.

More details: Prodeum Exit Scam

3. How to Spot a Fake ICO Scam

Red Flags of Fake ICOs

- Anonymous or Fake Team Members – No verifiable LinkedIn profiles.

- Plagiarized Whitepapers – Copied content from legitimate projects.

- No Working Product or Prototype – Only vague promises and buzzwords.

- High-Pressure Tactics – Urging investors to “act fast” before prices rise.

- No Clear Roadmap or Technical Details – Lacking a realistic development plan.

How Scammers Promote Fake ICOs

- Fake YouTube and Twitter/X Influencers – Promoting ICOs for quick profits.

- Telegram & Discord Investment Groups – Fake community engagement to boost credibility.

- Paid Press Releases – Misleading news articles creating false legitimacy.

- Deepfake CEO Interviews – AI-generated videos of non-existent executives.

4. How to Avoid Fake ICO Scams

- Verify the Team. Check LinkedIn profiles and look for genuine industry connections.

- Read the Whitepaper Critically. Look for copied content and unrealistic promises.

- Check Smart Contract Code. Scam ICOs often lack a working smart contract.

- Look for a Prototype or MVP. A legitimate project should have a minimum viable product.

- Avoid Time-Sensitive Investment Pressure. Scammers use urgency to trap victims.

5. Tools to Detect and Prevent Fake ICOs

- ICO Bench – Reviews legitimate ICOs and flags suspicious ones.

- ScamSniffer – Detects fake websites and ICO platforms.

- RugCheck.xyz – Analyzes crypto projects for fraud indicators.

- Etherscan & BscScan – Tracks ICO smart contract activity.

6. Legal Actions and Regulatory Warnings Against Fake ICOs

Recent Crackdowns

- SEC Lawsuits Against ICO Fraudsters

- FBI Warnings on Fake Crypto Investment Schemes

- Interpol Cybercrime Task Force Monitoring ICO Scams

More on crypto scam prevention: FBI Cybercrime Alerts

7. How to Recover If You’ve Been Scammed

- Report the Scam. Notify regulatory agencies and law enforcement.

- Check for Legal Action. Some ICO scams lead to fund recovery efforts.

- Monitor Smart Contract Activity. Track stolen funds on blockchain explorers.

- Warn Other Investors. Spread awareness to prevent others from falling victim.

Conclusion

Fake ICOs exploit investor enthusiasm and lack of due diligence to steal funds. Scammers fabricate partnerships, create fake teams, and use high-pressure tactics to trick victims into sending crypto.

To protect yourself, always verify the team, check for a working product, and avoid time-sensitive investment schemes. If you found this guide helpful, share it to help others stay safe from ICO fraud.